Your Company Pension Deadline Won’t Wait!

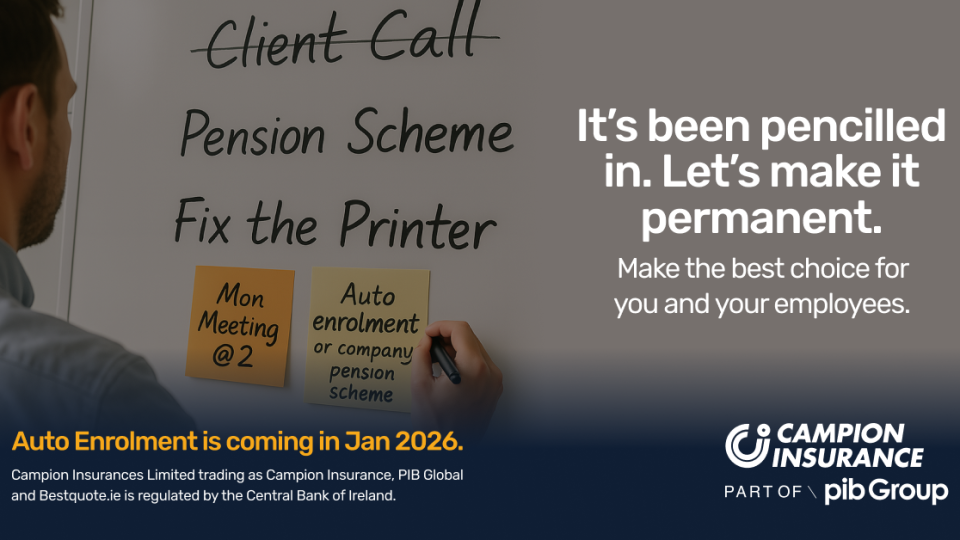

It’s time for employers to make key pension decisions in advance of pension auto-enrolment going live next January.

With an office here in Ennis, Campion Insurance has over 40 years experience, and is one of Ireland’s largest insurance brokers offering expert financial advice. In this short article, the Campion Insurance team outline the pension options facing employers next January.

Be Ready!

In Ireland, we live by the phrase “Sure it’ll be Grand”. But when it comes to deciding between Auto Enrolment and a Company Pension Scheme time is running out. Auto-enrolment launches in Ireland in January 2026, ready or not, employers and employees will be legally required to contribute to a pension scheme.

What follows is a simple jargon-free set of facts to help you understand the pension options that may be better for you and your employees.

Auto Enrolment vs. Company Pension Scheme

Ireland’s new Auto Enrolment Retirement Savings System is launching in January 2026. While it’s designed to solve the pension coverage gap, it comes with limited flexibility, modest early contributions, and reduced tax advantages—especially for higher earners.

Imagine offering your team a pension scheme that outperforms the government default: greater value, smarter tax benefits, and customised to your business needs. You don’t just meet regulations— you lead.

By setting up a company pension scheme now, you give your company options. Whether starting fresh or improving your current setup, you can opt out of the default system and design a pension scheme that works best for your employees.

What are the benefits of setting up a Company Pension Scheme?

1. Higher Tax Relief

Company Pension Scheme contributions qualify for income tax relief* up to 40% for higher rate taxpayers—far more valuable than the 25% equivalent in Auto Enrolment.

*Single taxpayer – €44,000@20%, Balance@40%

2. Early Retirement Flexibility

Employees can access pension benefits from age 50—unlike Auto Enrolment, which locks access until age 66.

3. More Investment Choice

Company Pension schemes offer a wider range of funds and active/passive strategies—tailored to risk preference and retirement goals.

4. AVCs Allowed

Company schemes permit Additional Voluntary Contributions (AVCs)—letting employees top up their pot over time.

5. Flexible Contribution Rates

Employers can set their own contribution levels beyond the AE scheme limits, boosting benefits for loyal staff .

6. Better Death-in-Service Benefits

If an employee passes away, Company Pension schemes can provide up to 4x salary tax-free plus personal contributions—a significant uplift compared to AE.