Auto-enrolment is around the corner – Darach Honan gives an overview

Darach Honan, of Honan Financial Services gives an overview and compares auto-enrolment to a private pension

After many false dawns, Auto-enrolment is around the corner with a definitive start date of January 1st, 2026. Auto-enrolment is estimated to affect 800,000 workers in Ireland who currently have no pension coverage.

Who will be Auto-enrolled?

· Those who earn over €20,000

· Aged between 23 and 60

· Are not already in a pension scheme which goes through payroll

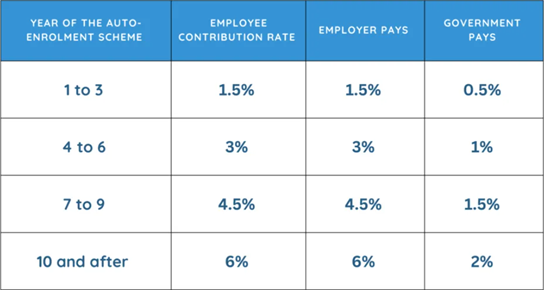

The full cost of autoenrollment will be rolled out over ten years. Initially, employees will be expected to contribute 1.5% of their salary to pension, employers will match this contribution, and the state will top this up with a 0.5% contribution.

This will rise to 3%, 3% and 1% in year 4. It will rise again to 4.5%, 4.5% and 1.5% in year 7. Finally in year 10 onwards the employee will be contributing 6%, the employer 6% and the government will contribute 2%.

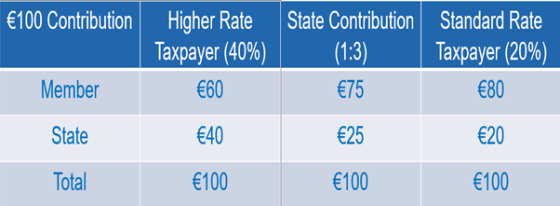

In effect, the state contributes €1 for every €3 the individual contributes.

How will contributions be collected?

The National Automatic Enrolment Retirement Savings Authority (NAERSA) was established to administer the scheme. Contributions will be made to the Auto-Enrolment fund via payroll and collected in a similar fashion as tax, prsi and usc. It is promised to be a seamless operation. Once NAERSA have collected the contributions it will be allocated to each individual’s fund and people will have access to an online portal which will reflect the value of their pension pots and allow them to choose their investments. There is no financial advice for members of AE.

How does AE compare to a private pension?

Of the 800,000 people who are expected to be auto-enrolled, 200,000 of those pay the high rate of income tax.

A private pension arrangement is far more beneficial than Auto-enrolment for someone who pays the high rate of tax. For someone who pays the standard rate of tax it is more debatable.

This is because of the tax reliefs available for private pensions. If I pay the high rate of tax I receive 40% tax relief on all contributions to my pensions. If I pay the standard rate of tax then I receive 20% relief on my contributions. However, Auto-Enrolment offers me a 25% contribution to my pension.

Other benefits to a private pension include, better access options, more investment options and receiving financial advice on your pensions.

For business owners it is important to take stock of current pension arrangements for themselves and their staff asap. While AE is not going to start until January 1st, if you are not a member of a payroll deducted pension scheme in November then you will be brought into the AE scheme in January.

If you have any questions, please get in touch via email: Darach@honanfs.com

or call: 087-1277155.